Founded by entrepreneur William Li less than a decade ago, Nio has been making strides in the Chinese market with its expanding range of EVs – first SUVs and latterly saloons. Following an initial foray into the Norwegian market in 2021, the brand has now launched its full European expansion program, with the range-topping EL7 SUV and the ET7 and ET5 saloons available to buyers in the Netherlands, Germany and Denmark. Fei Shen joined Nio in 2015, when the company was still in its earliest startup days, signing on as employee number 274. Now the company has a workforce of over 15,000. His expertise lies in power systems, specifically very high-power, grid-level applications, and he currently holds the position of SVP at Nio Power, the arm of the company responsible for battery swapping, charging and infrastructure development. Automotive Powertrain Technology International spoke with Shen at Nio’s launch event in Berlin to gain an insight into the company’s unique approach to the EV charging conundrum.

Swappable advantage Prior to Nio’s European event, Shen undertook a 4,000km trip in one of the company’s ES8 SUVs, providing an opportunity to see Europe’s charging network up close. Overall, he says he was impressed with what he saw, even remarking that in terms of fast chargers, Europe was maybe ahead of China. However, Nio’s USP is its battery swapping approach, something that other manufacturers have toyed with but have failed to advance. Owners can drive to one of the company’s swap stations, of which there are currently around 1,150 in China, and in five minutes have their depleted battery swapped for a fresh unit via an automated process. Nio plans to have a further 1,000 of these stations operational in Europe by 2025. According to Shen, the initial decision to pursue battery swapping was simple. “We considered it the only means to make a user experience that is comparable with gasoline refueling.”

Swappable advantage Prior to Nio’s European event, Shen undertook a 4,000km trip in one of the company’s ES8 SUVs, providing an opportunity to see Europe’s charging network up close. Overall, he says he was impressed with what he saw, even remarking that in terms of fast chargers, Europe was maybe ahead of China. However, Nio’s USP is its battery swapping approach, something that other manufacturers have toyed with but have failed to advance. Owners can drive to one of the company’s swap stations, of which there are currently around 1,150 in China, and in five minutes have their depleted battery swapped for a fresh unit via an automated process. Nio plans to have a further 1,000 of these stations operational in Europe by 2025. According to Shen, the initial decision to pursue battery swapping was simple. “We considered it the only means to make a user experience that is comparable with gasoline refueling.”

However, as the company matured, the perceived benefits of battery swapping clarified and various other advantages became apparent. “It is also about the implementation of ‘Battery as a Service’, which means we separate the battery cost from the vehicle,” he continues. Shen makes the point that over a vehicle’s lifetime, the cost of the battery and electricity used is not very different from that of ICE running costs – although this may change if energy prices continue to rise. The difference is that the ICE owner does not buy a 12- to 15-year supply of oil from the outset. “When EV users buy a car, they must spend additional money for the battery. So we considered that we should lower the initial price for the user to own an EV by separating the battery and vehicle.”

Another benefit Shen flags in favor of battery swapping is the potential for future upgrades. “Battery technology can be out of date very quickly and that is not great for the user experience. But if we separate the battery from the vehicle, then the user will always have the latest technology.” The final argument he brings forward is the efficiency that battery swapping offers at the system and grid level. “The battery swap station can charge batteries inside the station. At the same time, they can charge outside vehicles using chargers that are connected in parallel with the swap station and both the station and the chargers can share power from the local utility.”

Another benefit Shen flags in favor of battery swapping is the potential for future upgrades. “Battery technology can be out of date very quickly and that is not great for the user experience. But if we separate the battery from the vehicle, then the user will always have the latest technology.” The final argument he brings forward is the efficiency that battery swapping offers at the system and grid level. “The battery swap station can charge batteries inside the station. At the same time, they can charge outside vehicles using chargers that are connected in parallel with the swap station and both the station and the chargers can share power from the local utility.”

The use rate of most chargers is only around 10%, whereas swap stations run at 30-50%, meaning the additional load of chargers on the same site can be easily accommodated. The chargers are also able to run from the batteries stored in the stations, which in turn can be charged using off-peak electricity. The overall result is a more balanced load on the local electricity grid. “The swap station is a large-capacity storage system; with 30 batteries you have 1.3MWh. We can also charge when prices are lower, or when there is an excess of clean energy – solar or wind – in the power system.”

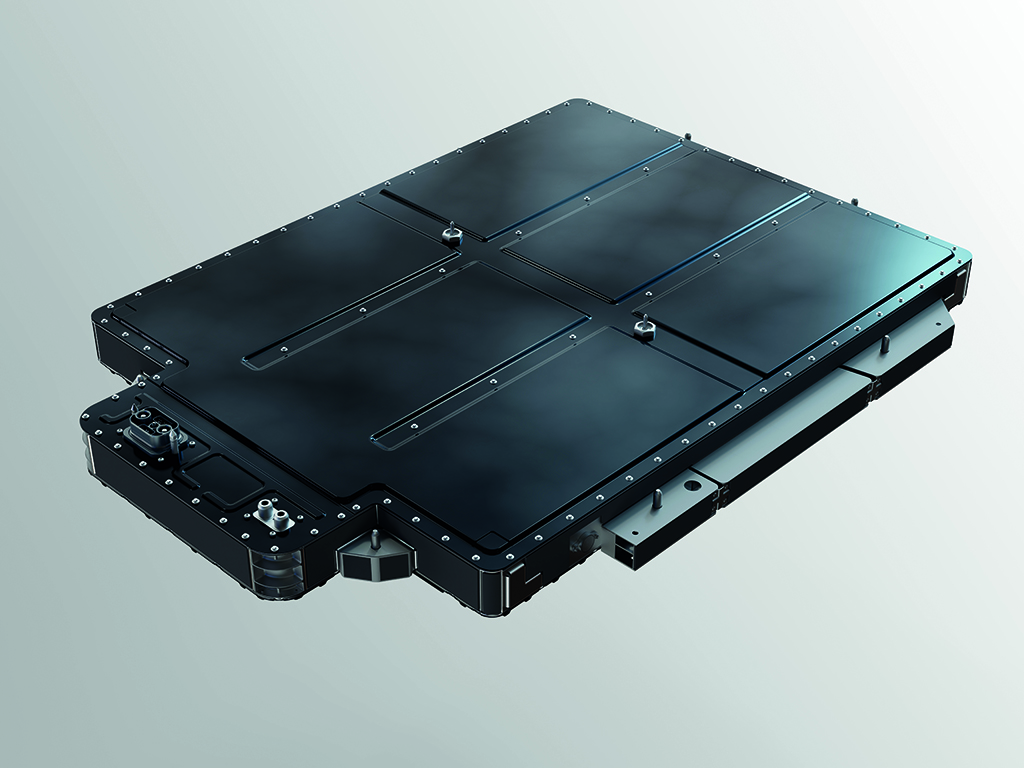

Big batteries One of the most appealing features of Nio’s battery swap system is that its batteries, regardless of capacity, share the same footprint and are designed to be backward compatible. Currently its highest capacity offering is 100kWh. A 150kWh unit that is under development was due to hit the market in 2022 but its release has been delayed. Impressively, though the new battery will give a 50% increase in capacity, the weight of the pack has grown only marginally compared with the 100kWh variant. “We have defined the same size, a very, very similar shape and almost the same weight for the battery. To increase the battery capacity the energy density was increased, but with the new technology the weight is not increased.” He points out that the large pack will only be relevant to a small proportion of customers, and the company expects most will still opt for the standard range offering, taking advantage of being able to make a short-term upgrade to larger capacities as their needs dictate.

“Most of the time, users only drive their vehicles in cities, and most [in the China market] choose the 75kWh battery.” Notably, Shen adds that there have been multiple requests from users for a smaller 50kWh pack to reduce costs further, but this is not something the company is developing. “It’s very challenging and I think the schedule is slightly behind plan,” admits Shen. “We are still working on the 150kWh battery. We originally planned to deliver it at the end of this year but now it is scheduled for release in China in Q1 2023.” He adds that the battery will eventually be rolled out in Europe once it meets the required standards. “It is quite an innovative technology and increasing the energy density of the battery in the same package size is a bigger challenge than we expected.”

The official company line is that it is working with long-term battery partner CATL on the development of this pack. However, a relative newcomer to the battery market in China, WeLion, stated earlier this year that it had been developing a semi-solid-state chemistry for Nio to use in the pack. Whichever turns out to be the final solution, if Nio can bring a 150kWh battery to market by 2023 it will be a major milestone for the industry and ahead of most of its competitors. While Nio is still climbing the ladder to compete with established manufacturers, its lack of legacy infrastructure burden and what appears to be a genuinely fresh approach to vehicle design, development and manufacture, not to mention management structure, appear to make it well placed to capitalize on the EV transition. Confidence is certainly high, with Shen concluding, “The reason I think we can do these kinds of things much better than other companies is because we do it as one team.”