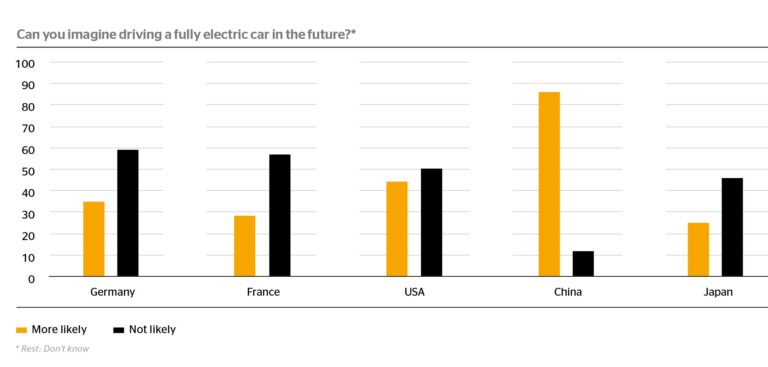

According to the 2020 Mobility Study carried out by Continental, the results of which have just been published, 59% of consumers in Germany still state they cannot imagine buying an electric car in the future. Working in partnership with social research institute INFAS, subsequent groups of people in France, the USA, Japan and China were also surveyed about their mobility habits.

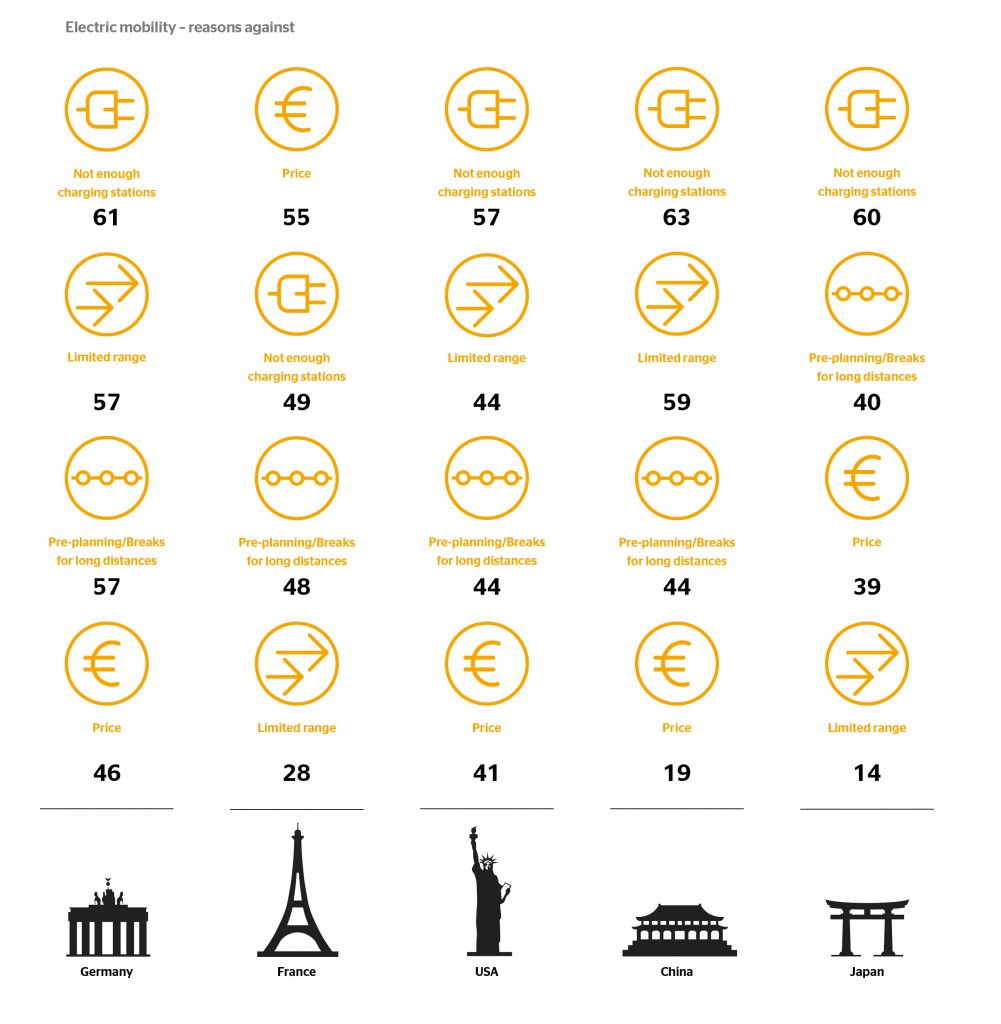

Respondents’ main complaints included low range when compared with petrol and diesel vehicles, a lack of charging stations and a higher initial purchase price. The extended survey showed that 57% of French and 50% of US respondents– and an even lower 46% in Japan – cannot yet see themselves using an electric car over other conventional options.

Continental executive board member Helmut Matschi commented, “Smart connectivity considerably enhances the appeal of electric mobility. Particularly when it comes to the issue of range, connectivity is a key building block for greater acceptance among drivers. Connected vehicles can help by combining the search for a charging station with the calculation of the most efficient route, for example. High-performance computers (HPCs) from Continental, which are used in Volkswagen’s ID electric series, among other models, connect e-vehicles with their environment in a variety of ways – providing drivers with quick information about the nearest charging stations, for example.”

However, since 2013 a positive trend can be seen in consumer opinion, with an ever-growing portion of car owners saying they intend to buy an EV in the future – this proportion has risen by 28% in the USA, 27% in China and 18% in Germany. France and Japan’s views toward purchasing EVs grew at a much slower rate of 3% and 1% respectively.

Matschi, responsible for vehicle networking and information at Continental said, “The figures show that Continental is playing the right card for the future with its electric mobility offering. At the same time, it is becoming clear that manufacturers and suppliers must take consumers’ reservations about electric mobility seriously – even if seldom justified – and must refute them if the technology is to achieve a broad breakthrough on the market.”

Incentives are being offered by policymakers in all the countries studied, which include monetary enticements in the form of purchase premiums to try and steer potential purchasers into buying an EV over a combustion vehicle. Germany has since increased incentives as part of a stimulus package to help ease the impact of the coronavirus pandemic on the country’s economy, with China extending premiums that were set to expire.

All countries included in the study are also currently expanding charging infrastructures to support growing EV demand and to meet key arguments relating to range anxiety. Despite these concerns, the majority of peoples’ daily mobility needs could be met with an EV due to most being short journeys and an ever-increasing number of charging stations becoming available at home, work and public spaces.

The survey did show that EV manufacturers face obstacles that technological advancements cannot help with, not least the fact that a third of German and a quarter of French respondents doubt EV technology is truly an environmentally friendly option. Conversely, however, the percentage of people with the same view is much lower in the USA at 11% and in Japan it is just 1%.